Financial Management

Traditional finance operations often struggle with fragmented, disconnected systems that create silos across departments. These inefficiencies slow down decision‑making, reduce agility, and make it harder for organizations to adapt quickly to evolving market demands, regulatory requirements, and growth opportunities.

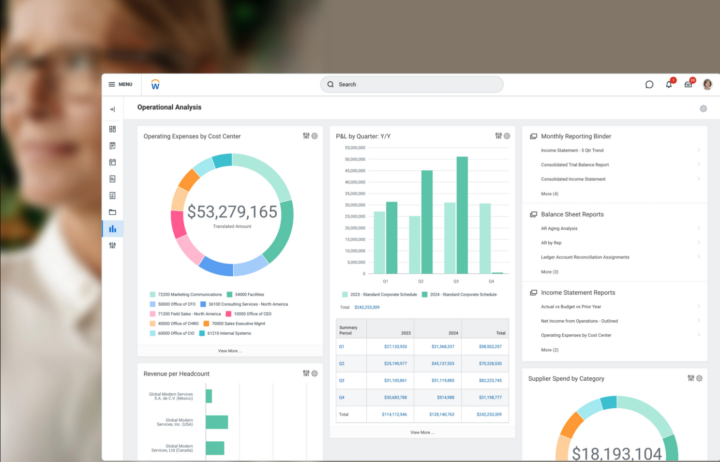

Workday Financial Management transforms your finance function by consolidating fragmented processes onto a single, automated platform. This integration streamlines operations, significantly boosts efficiency, improves the user experience, and mitigates operational risk.

What are the benefits of Workday Financials?

- Unified Digital System: Replaces fragmented systems with a single platform to digitize the entire finance function

- Core Functionality: Supports essential operations including transaction processing, consolidation, and compliance

- Multidimensional Reporting: Provides powerful, in-depth reporting capabilities for better insights

- Strategic Enablement: Empowers finance professionals to manage processes efficiently and drive organizational strategy and growth

- Global Risk & Compliance: Helps teams proactively manage risk and ensure compliance across both local and international operations

- User-Friendly Platform: Designed for ease of use, enhancing adoption and productivity

Benefits

Real-time Insights

Unlimited Scenarios

Scalable Cloud Power

World-class Security

Let's turn your digital challenges into competitive advantages!

Contact UsFAQs

- What is Workday Financial Management?

Workday Financial Management is a cloud-based financial management suite that combines data, context, and AI to provide a single trusted source of truth for finance.

It is designed to deliver faster insights, smarter actions, and greater adaptability for growing, service-centric organizations. - How does Workday improve financial insights and reporting?

Workday delivers real-time visibility into what drives the business by uncovering critical financial insights across the organization.

Its platform turns both structured data and unstructured documents into decision-ready information, helping finance leaders move from hindsight to insight. - What finance processes can Workday automate?

Workday intelligently orchestrates end-to-end finance processes across record to report, procure to pay, and contract to cash.

AI agents handle operational complexity such as anomaly detection and recommendations, while finance teams retain strategic control. - Can Workday turn external data into accounting entries?

Yes, Workday automates and simplifies how external data is integrated, enriched, and converted into accounting entries.

This process is fully transparent at every step, helping organizations maintain accuracy and control over multi-source financial data. - What tools does Workday offer for audit and financial assurance?

Workday provides a Financial Test Suite that includes Financial Test Agent and Financial Audit Agent to strengthen financial assurance.

These tools automatically identify anomalies, accelerate evidence collection, and validate controls in real time to streamline audits and reduce risk. - How does Workday support risk management and compliance globally?

Workday offers comprehensive visibility across geographies, allowing organizations to standardize finance processes globally while adapting to local requirements.

Always-on auditing and continuous electronic evidence help proactively manage risk and maintain compliance in multiple jurisdictions. - Is Workday Financial Management scalable for growing businesses?

Workday runs on a secure, flexible foundation that adapts as business needs change, including growth and market shifts.

It is built to scale with service-centric enterprises while maintaining performance, control, and robust audit capabilities.